Deferred tax related to assets and liabilities arising from a single transaction (Proposed Amendments to IAS 12) Issues Paper

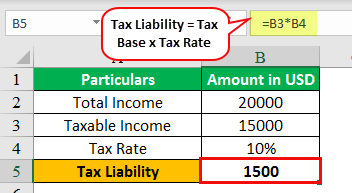

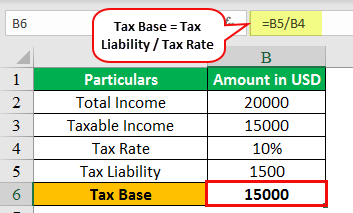

Twitter 上的Dheeraj:"Tax Base (Definition, Formula) | How to Calculate Tax Base? (Examples) https://t.co/niH4jOe94g #TaxBase https://t.co/ei1tyFCXiS" / Twitter

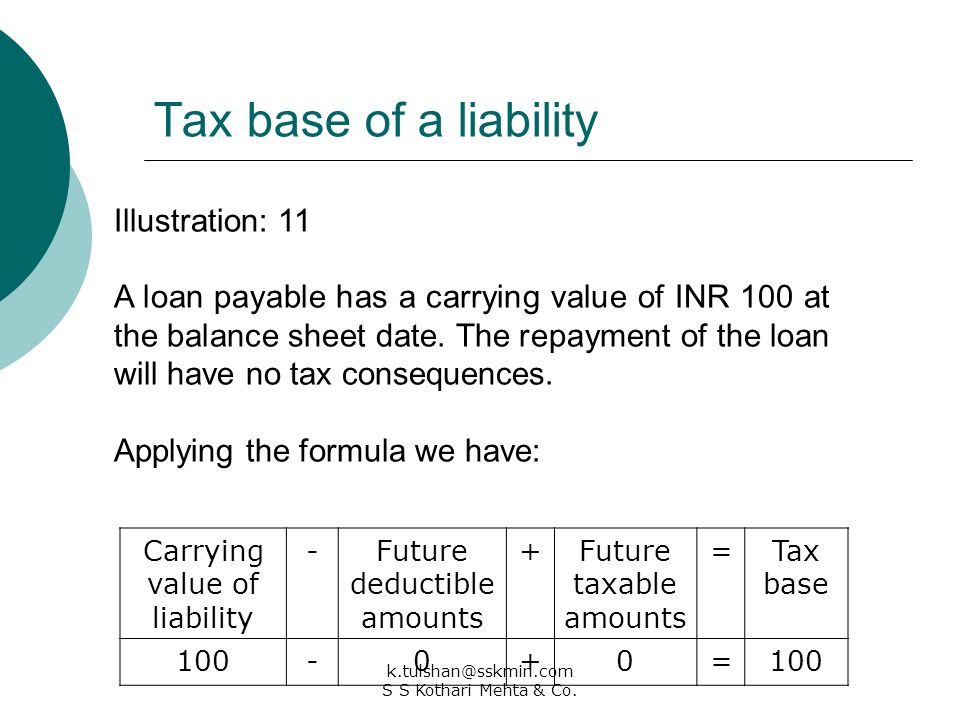

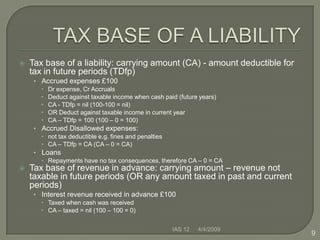

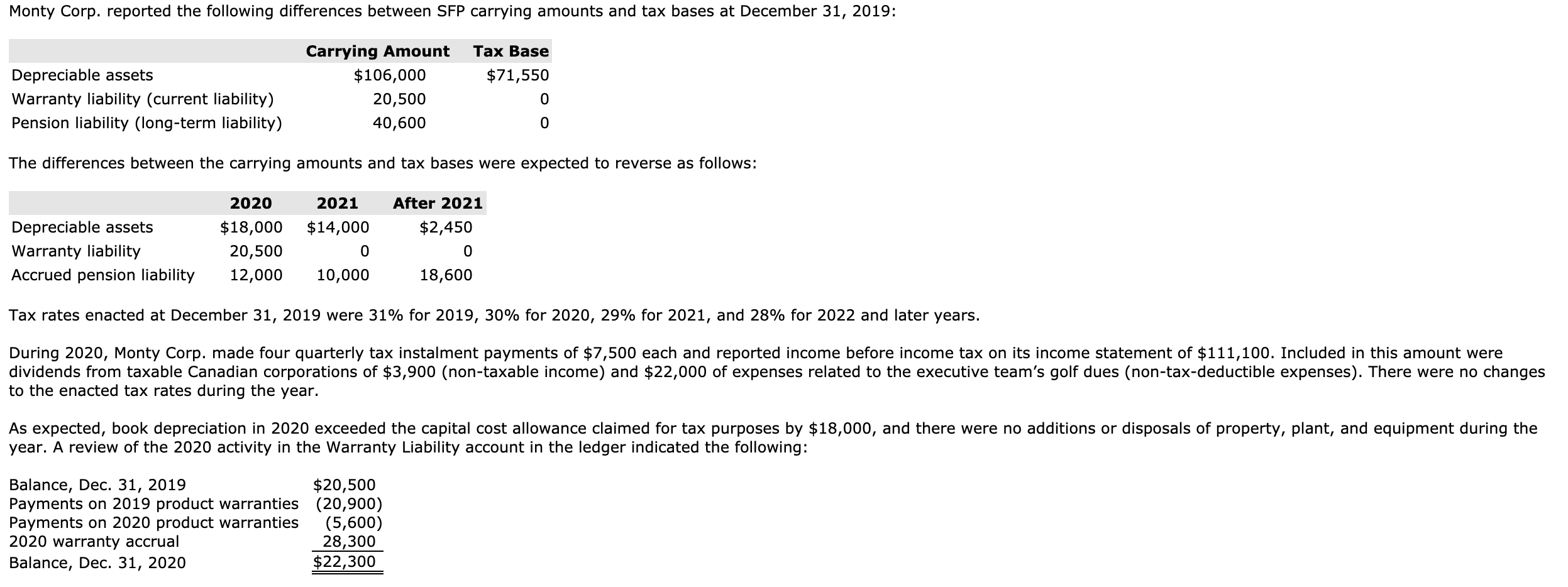

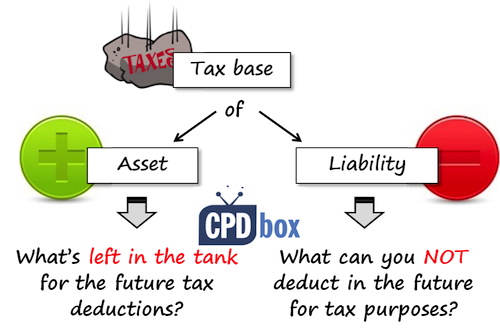

Module 3 Activity 1 - Lecture notes assignment - 1. What entities are required to report deferred - StuDocu